Happy Monday!

My blog brought to you by Legacy Investing & Wealth Management gives you a quick and easy read focusing on stock market education, empowering the newer investor as well as giving you the most recent stock market analysis. For more information including past blogs please go to www.LegacyInvesting.net; look for the Market Mondays tab under “The Legacy” for all blogs.

Saving money is one of the wealth pledges you can find on my website under “The Legacy” tab and what I feel led to discuss today. Now more than ever, saving money is especially important if you want to build wealth. There is a new Administration and trust me, the middle and lower classes will not benefit from the new policies Trump is planning on implementing. First, making all things “American”, implies less overseas trade of cheap foreign goods and services which will drive up the cost for just about everything, creating inflation. Inflation simply means it will cost more to purchase things you consume. Second on his agenda is cutting taxes for the wealthy as well as business taxes. None of us fully know the President’s ever evolving platform but we do know his intent on slashing government programs. This will be devastating for our communities creating more poverty than what we experience today. This Ronald Reagan style “trickle-down economics” didn’t work before and it’s not going to work today. The more money that is given to the wealthy, the more money they keep. This wealth doesn’t spread or flow into the economy as one would think. However, it’s been proven time and time again that stimulus given directly to the middle and lower classes flows right into the economy and expands the middle class.

Many of us do not have a money cushion to refer to in case of hard times nor any consideration for retirement. That is one reason why debt has gotten so out of control, and disproportionately in the Black community. Did you know Whites are about 16x wealthier than Blacks?! According to a recent Forbes study, a typical White household is worth $111,146 while a Black household has $7,113 in wealth! Again, we don’t know how policy will unfold but entitlement programs (i.e Social Security, Medicare, etc.) may be cut or even eventually phased out which is why saving money and investing now is absolutely imperative.

I don’t just preach this stuff and not do it myself which is why during these uncertain times I’ve even taken measures to cut our own spending, focusing on saving more and creating multiple streams of income. Worrying about how I’m going to make ends meet is not something I’m going to deal with as I get older; so taking steps now is vitally important!

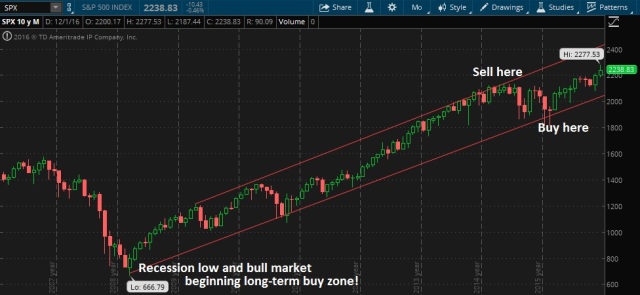

Roughly 2239 was where the S&P 500 ended the year in 2016 and we are up about 2.5% (2293 as of the mid-day). We have been in a consolidation pattern since mid-December, meaning we are trading sideways in a fairly narrow range. The rally that started Election Day has stalled and the market is waiting on another reason to go either higher or lower. We may have a small correction which could be around 5% but due to our current political landscape, I think the general direction of the stock market will be higher over the next few years. That is given this Administration doesn’t get us into big trouble.

A few trades that have been working out are stocks in Industrials, Banking, Technology, Emerging Markets, and even Gold, Copper and other materials. They should continue to work in this environment and I would be buying them when the stock market pulls back. As everything changed when Trump was elected, be careful on Gold since inflation and uncertainty concerns are the only real reason this has been rising. Rising interest rates and stock market prices as well as a rising dollar are the reasons Gold investors should be careful.

Please visit our website at www.LegacyInvesting.net and contact us today for a FREE consultation on becoming financially fit and learning how to make money investing in the stock market. You can make money in ANY type of market (bull or bear). When we meet I’ll give you more information about our services and find out what your financial goals are. If I can help you, we can move forward; if not, no problem but I’m always just a phone call away from any questions or quick advice you want. Get your finances in shape this year! Let’s connect and build generational wealth together.

Disclaimer – Legacy Investing & Wealth Management LLC or any of its advisers are not liable in any way for any losses incurred through trading by readers of this weekly blog. Any information or strategies of trading suggested here involve risk of capital loss and this weekly blog is not considered investment advice. Individuals who invest in securities are solely and completely responsible for any and every outcome that may occur.